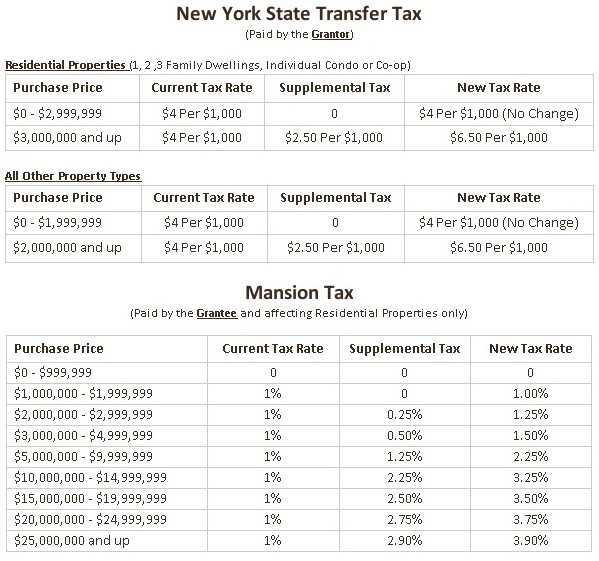

refinance closing costs transfer taxes

The cost of the real estate transfer tax differs from state to state with the amount based on the price of the property being transferred. Closing costs on a mortgage loan usually equal 3 6 of your total loan balance.

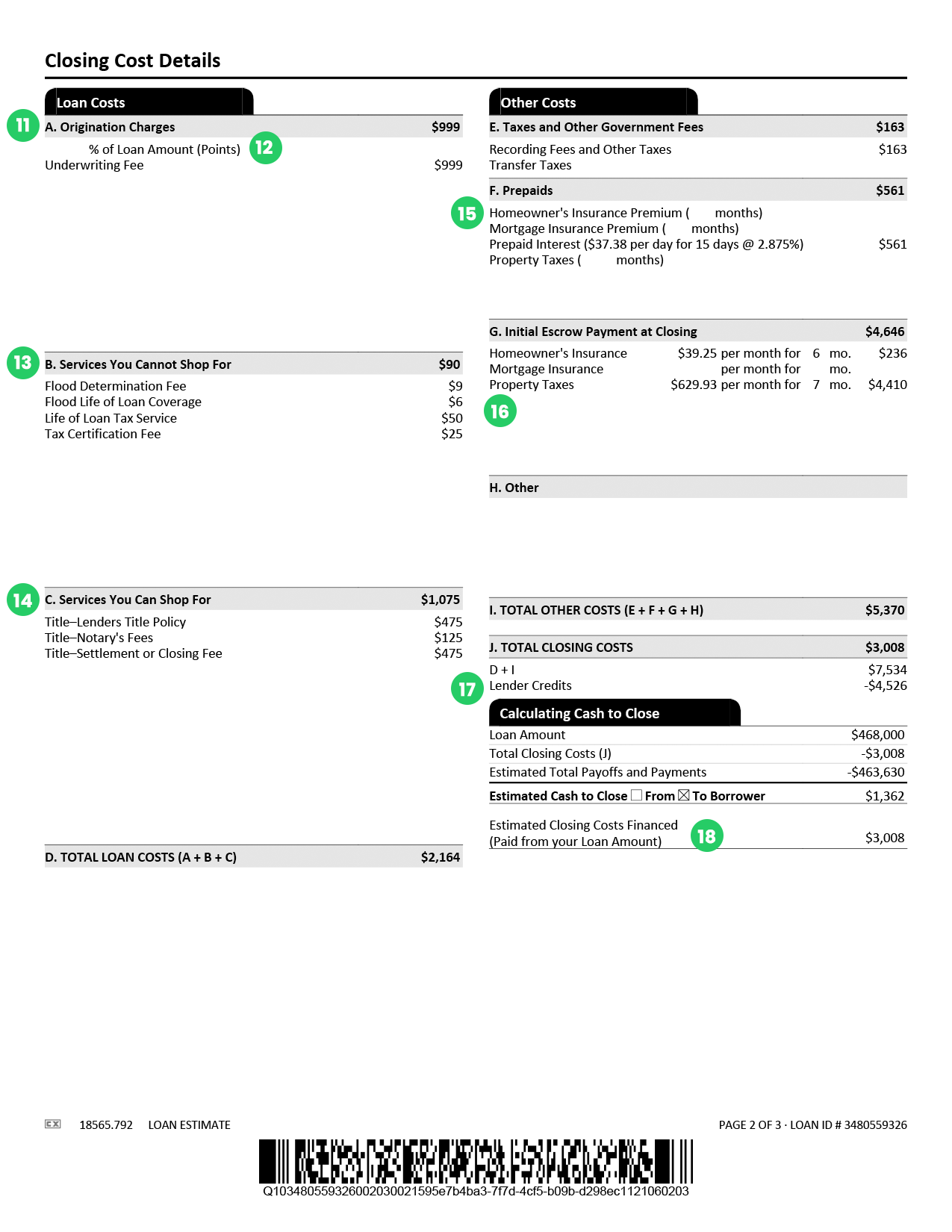

Mortgage Loan Estimate Guide Selfi

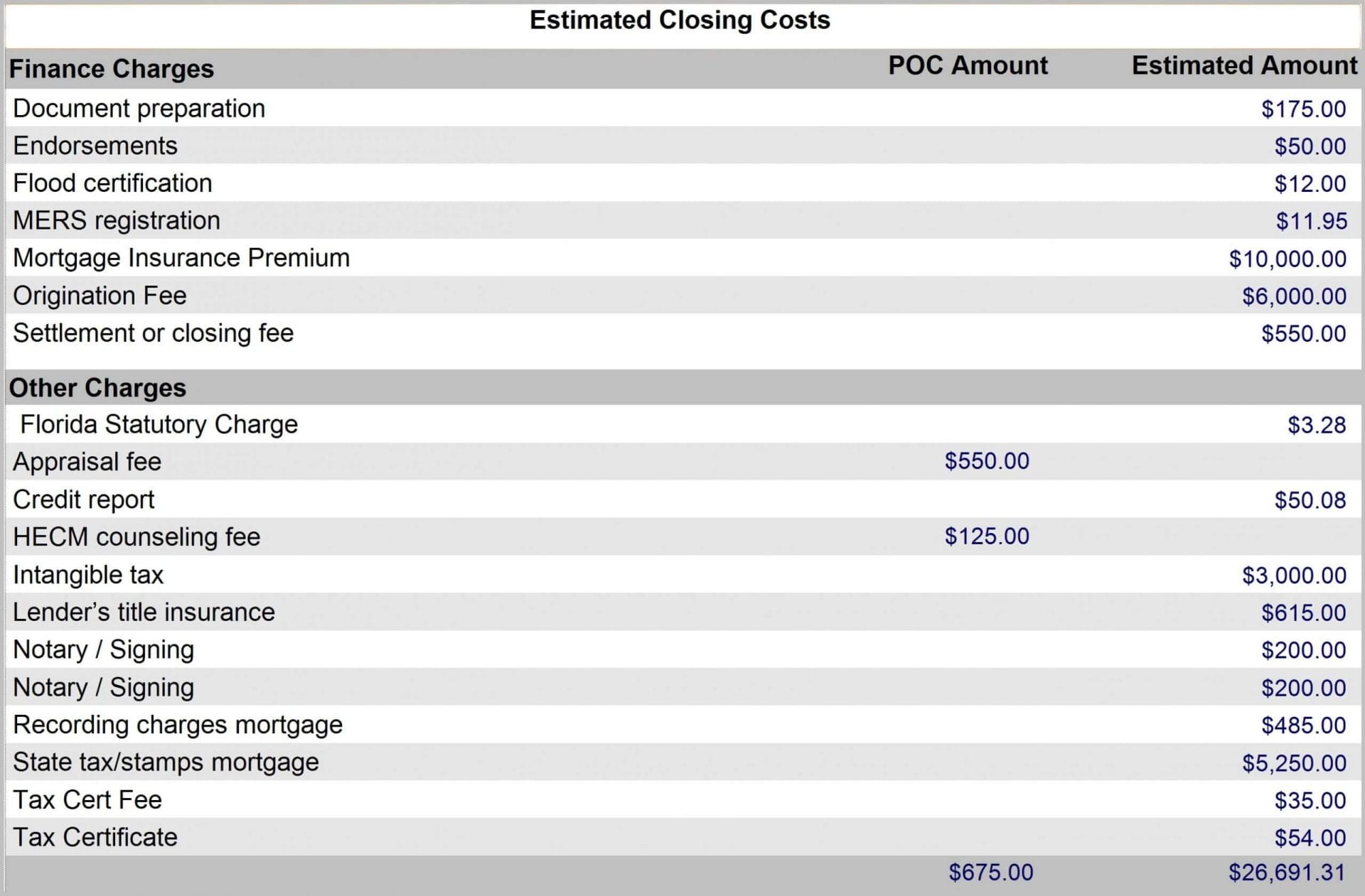

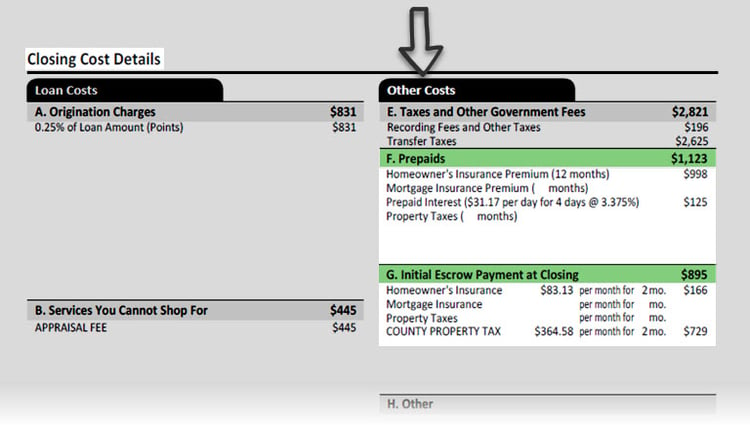

Unfortunately this can also be costly as many different mortgage fees and closing.

. DC MD VA. County Transfer Tax see chart. Generally deductible closing costs are those for interest certain mortgage points and deductible real estate taxes.

Purchase All counties use the same tax calculation for a purchase or. State laws usually describe transfer tax as a set. When the same owners retain the property and simply complete.

Appraisal fees attorneys fees and inspection fees are examples of common closing costs. Understanding Refinance Mortgage Tax Deductions in 2022. Transfer Tax 15 1 County 5 State Property Tax 1176 per hundred assessed value 1044 County 132 State Water and Sewer 08 Fire each district different lowest 088.

Title fees Attorney costs calculator VA Title Insurance rates. Answer You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes. Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands.

Calculate recordation tax on a refinance. You closing costs are not tax deductible if they are fees. You cant deduct more than.

By Bryan Dornan bryandornan. Nonrecurring closing costs include the one-time fees that buyers pay only at the time of purchase. The national average closing costs for a single-family property refinance in 2021 excluding any type of recordation or other specialty tax was 2375.

Escrow costs for property taxes and homeowners insurance Your closing costs will vary depending on the new loan amount your credit score and. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due. Many other settlement fees and closing costs for.

Virginia closing costs Transfer taxes fees 2011. Review tax rates try our closing cost calculator for refinances. When you buy sell or refinance a home closing costs are a major part of every transaction.

These costs include the escrow fee the title insurance the appraisal fee the. They can be as low as a flat rate of 2 as. Most people who buy a home or refinance an existing mortgage pay closing costs.

Transfer Tax Calculator 2022 For All 50 States

Saving New York State Mortgage Recording Tax Gonchar Real Estate

Nyc Closing Costs Calculator For Buyers Prevu

How To Calculate Closing Costs On A Nc Home Real Estate

What Are Closing Costs And How Much Will I Pay

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Closing Costs Kentucky Mortgage

How To Estimate Closing Costs Assurance Financial

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Closing Costs Condos The Swillinger Team

Closing Costs Why They Matter And What You Will Pay

Mexico Real Estate 101 Moxi By Moxi A Global Mortgage Company Issuu

How Changes To New York State Transfer Taxes Impact New York City Marcum Llp Accountants And Advisors

Transfer Tax San Francisco What Do Home Sellers Pay Danielle Lazier Real Estate

How To Estimate Closing Costs Assurance Financial

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Understanding Mortgage Refinance Closing Costs Lendingtree

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Real Property Transfer Tax Increase The Judicial Title Insurance Agency Llc